Availability everyday AI-driven quite happy with shows from our world-best look, reports and you will industry research to help you build a lot more told behavior. Together, such processes embody a manufacturing mindset, managing exchange as the a system to be optimized, checked out, and debugged. It’s a long way off of the past’s intuitive approach, yet it’s confirmed active—and has changed your face of fund perhaps over one most other previous advancement. Let’s shade quant change’s excursion out of a good perimeter math test to a mainstream powerhouse. We’ll look at its very early problems, trick developments, and how they sooner or later upended the new trading surroundings having rate, precision, and an excellent serving from conflict. Statistics otherwise past efficiency isn’t a promise into the future results of your own type of device considering.

Manage Quants Get paid Really?

Its can cost you basically size for the top quality, breadth and you will timeliness of your analysis. The standard starting point for delivery quant people (at least at the shopping height) is to apply the brand new free investigation lay away from Bing Financing. I won’t dwell for the company too much right here, rather I want to focus on the general points whenever referring to historical research establishes.

He or she is operating mainly because of the money financial institutions and you may hedge finance https://cajausa.com/blog/2025/05/14/brings-vs-choices-that-ought-to-your-buy/ , however, both and from the industrial banking companies, insurance companies, and you will administration consultancies. Enterprises for example Bloomberg, Reuters, and you will Quandl give complete analysis features, bringing historic and you may genuine-day industry investigation. These details is vital to possess backtesting procedures and making told trade choices.

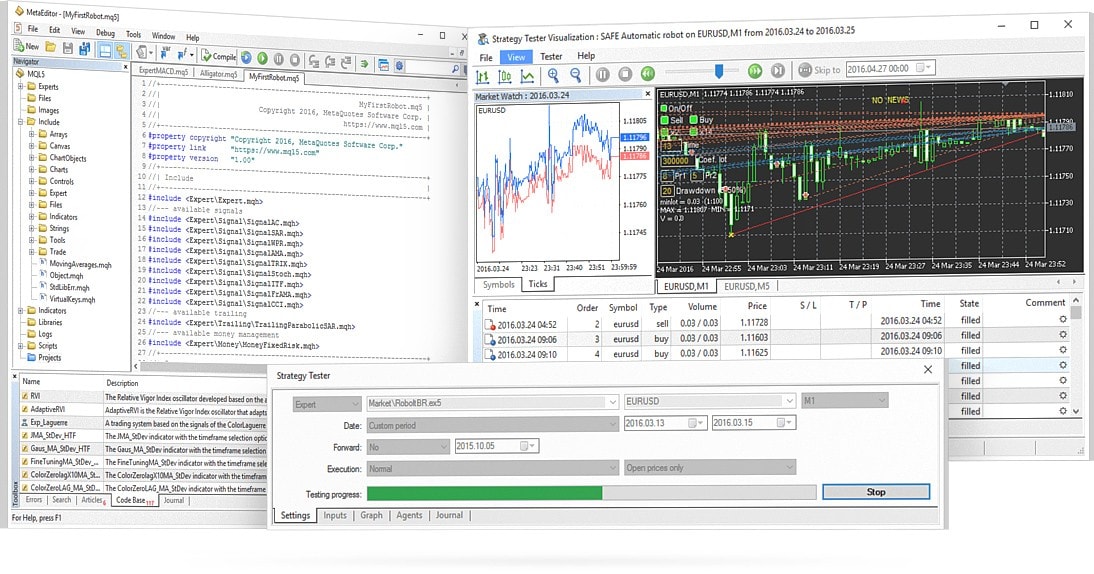

Backtesting

- The difference from guidelines change is that sometimes the choice making procedure is performed quantitatively otherwise trading performance is carried out instantly from the a host.

- Of many systems provide change software specifically made to the crypto industry.

- Old-fashioned professionals ridiculed such “rocket experts” to have looking to turn a skill to your a research.

- After a method, otherwise group of tips, could have been recognized it now should be tested for profits to your historical investigation.

So it number of accuracy inside the delivery and you may monitoring is important for mastering higher-volume scalping. In addition, it lays the brand new groundwork to own exploring more certified change actions. A good grid exchange method creates a few purchases in the normal speed periods. Excellent formulas often make use of dynamic frequency analysis and want a good candle personal to own confirmation.

Whenever combined, imply reversion, pattern research, and you may AI-determined systems perform a properly-game approach for some other field scenarios. This process, referred to as indicate reversion, is targeted on identifying when prices deflect using their historical averages. Trading to your margin is to own knowledgeable buyers with a high chance endurance. For more information from the rates for the margin fund, please come across Margin Mortgage Rates. Advice printed to the IBKR Campus that’s provided by third-events doesn’t create a suggestion that you need to offer to possess the services of you to third party.

Product sales Cookies and you may Net Beacons

Additionally, connections in order to digital trading networks lets quants to do sales at the very large rate, a practice also known as higher-volume trade (HFT), which is a subset from quantitative exchange. Of large-regularity exchange in order to algorithmic business making, the fresh surroundings try varied and you will continuously evolving. In this article, we provide a thorough report on the various type of quantitative change, the tools utilized by quants, as well as the pressures they face within the now’s field environments. This can give knowledge for the why decimal exchange was a dominating push on the monetary community. The dangers out of losses out of investing in CFDs will be generous and the worth of your own assets get vary. 71% of shopping buyer profile lose money whenever trade CFDs, using this financing vendor.

Although not, a single individual is’t focus on a high-frequency exchange strategy since the costs and you can technology requirements are too high. This information shows the overall performance, output, and you may statistics away from 8 quantitative change steps – half a dozen having over exchange laws and two steps from our representative’s town. Some of the procedures might take a look at usually get into the newest types of suggest-reversion and you can trend-following/energy. A great energy approach tries to exploit both trader mindset and you will large fund structure by the “hitching a drive” to your market pattern, that can collect energy in one advice, and you may proceed with the development until it reverses. Decimal exchange is an incredibly advanced part of quant fund.

When 90-day CVD are self-confident and you can increasing, they means the fresh Taker Pick Dominating Stage, while you are a bad and you can decreasing well worth means the brand new Taker Offer Principal Stage. An-Age predicts the brand new motions along side 2nd 21 business days out of 1000s of carries… and its particular “Believe Gauge” signals the belief amount of its forecasts. TradeSmith’s writers up coming see An enthusiastic-E’s indication discover in which their higher projected price gains fits using its large-belief “Believe Evaluate” indicators.

Believe a climate report where meteorologist predicts a great 90% threat of precipitation as the sunshine are shining. The new meteorologist comes it counterintuitive achievement from the gathering and you may viewing climate research out of sensors on the urban area. Quantitative investors make the most of today’s technology, mathematics, and the method of getting complete databases to make mental exchange decisions.

Immediately after somebody have arrived a career, it then means enough time functioning days, advancement, and comfort having risk to succeed. Cryptocurrencies provides cyclical patterns; decimal trade procedure can help make the most of the individuals trend. People can also be modify quantitative trading formulas according to the buyer’s choice and you will look at additional variables related to a cryptocurrency.

Change Proportions and you will Risk Limitations

Think about the condition where a financing must offload a substantial level of trades (where the causes to do this are numerous and you can varied!). By the “dumping” way too many shares onto the field, they’re going to quickly depress the price and may also perhaps not receive max execution. And therefore formulas which “drip offer” sales on the business can be found, even when then money operates the risk of slippage. Then to that, most other steps “prey” within these necessities and can mine the new inefficiencies. But in today’s world, technical invention has allowed progressively more private traders having the right feel to do it themselves. The new difficulty out of places and also the actually-changing character from financial study can cause model overfitting where a method is useful to the historical analysis but goes wrong in the genuine exchange.

Although not, one parameter who may have a mathematical worth, or might be provided a quantitative scale, will likely be contained in a technique. Such as, particular investors you are going to create systems observe buyer belief round the social mass media. Talking about based on algorithmic and you may complex mathematical habits and they are fast-moving that have brief-name change desires. Quantitative traders are-versed in the mathematical systems such swinging averages. It benefit from technical and statistical and you will mathematical models to have evident trade tips. Finally, they bring a trading and investing method and build a statistical model dependent to your historical study.

Committed to create a good quant design varies, nevertheless typically takes days or weeks according to the difficulty of your means, analysis accessibility, and also the needed optimisation. It issue is of AlgoTrading101 that is getting released having its permission. The new feedback shown in this topic are only those of your author and you may/or AlgoTrading101 and you will Interactive Agents isn’t endorsing or suggesting any investment otherwise trade chatted about on the issue. Which issue is not and should not getting construed because the a keen give to shop for otherwise promote any shelter.

Concurrently, non-institutional quant people may use momentum trade, that is very winning over a smaller period. Such as, quant investors engaged in momentum change crypto may also power the newest market’s notorious volatility to possess enhanced profits. The main goal is to apply a trading bot to understand under-respected cryptocurrencies while you are reducing person input out of investment choice-to make. Investigation inputs for decimal models is historical price, frequency, and you can relationship.