Content

For many who take care of a blended average each day harmony of $ten,000 or higher, you’ll found $600 within 120 days of membership starting. For it incentive, you’ll must unlock another Pursue Total Checking account and you will Chase Bank account at the same time. Go to the offer web page to start the new profile or receive a coupon for the email address.

- All of our personnel performs hard every business day to save this information up-to-time and precise.

- One of the better ways to alter your take a trip experience are to get a great credit card that may create worth to you.

- The fresh Ink Organization Preferred Mastercard also offers more things for take a trip sales and offer you the capability to redeem their rewards due to Pursue Traveling℠ to own twenty-five% more value and you will import items to travel couples.

- When you become a member, register for it give to earn advantages, things and a lot of deals.

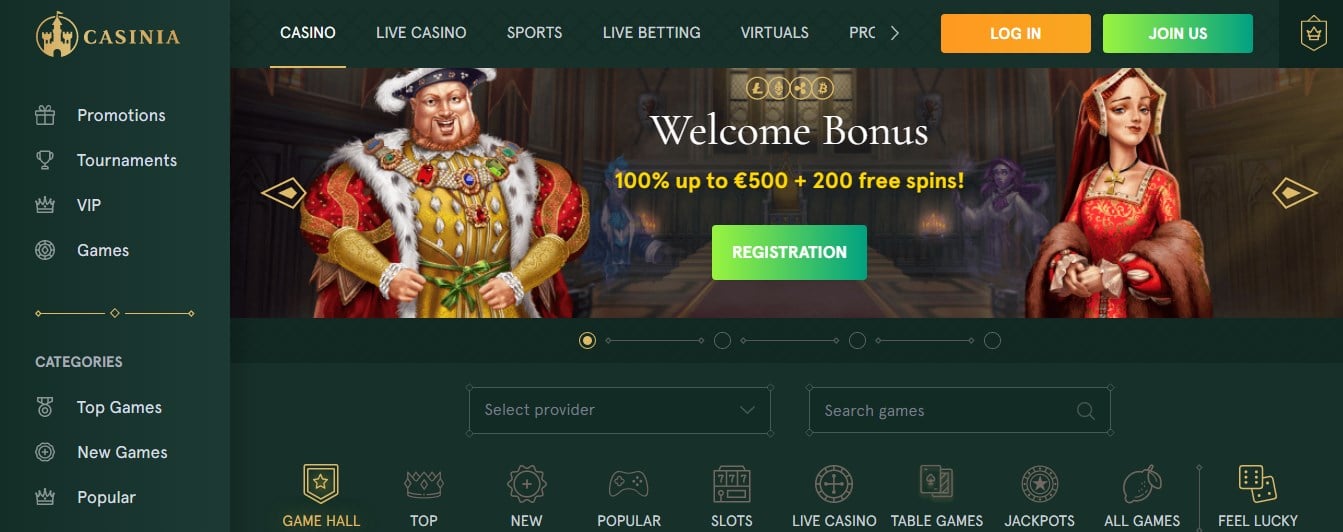

- You can take a closer look from the this type of unregulated sportsbooks thru our very own blacklist.

- The new Bluish Bucks Preferred Card is among the greatest bucks-straight back credit cards on the market.

Money One cards you to definitely secure Money You to definitely Miles

That’s why enterprises should be thinking about the value of their bonus arrangements and you may controlling them with most other perks and benefits. Chase’s you to definitely hard-and-punctual software laws is frequently known as the 5/24 rule. If you have unsealed five or even more credit cards that have people issuer across the prior two years, you’ll likely end up being denied for many Chase-granted playing cards with little threat of reconsideration. There isn’t a proper, consistent coverage you to restrictions the amount otherwise timing of one’s software which have Pursue. All round principle is always to limit applications in order to zero multiple personal and another company cards within this 90 days. Still, You will find as well as understand accounts of individuals being qualified for two personal notes within a month.

How to decide on an informed Financial Bonus

If we would like to spend reduced interest or earn significantly more advantages, the right card’s available to choose from. You can have an open conversation with these people to go over the results plus the press this link terms of the new incentives. Throughout times, if factors out of incentives are designed clear, they can try to be incentivizes to own personnel to improve their results. Such, a worker which discover their more effort would be compensated tend to become more attending just go and go beyond standards.

SoFi’s shortage of charges helps it be a robust contender for those trying to find an internet financial, and its own up to 3.80% APY to your savings and you will 0.50% APY on the examining balance try competitive. So it extra isn’t possible for many people, because it means a deposit of $250,one hundred thousand. The fresh burden to help you generating which extra is high, and most people won’t be considered.

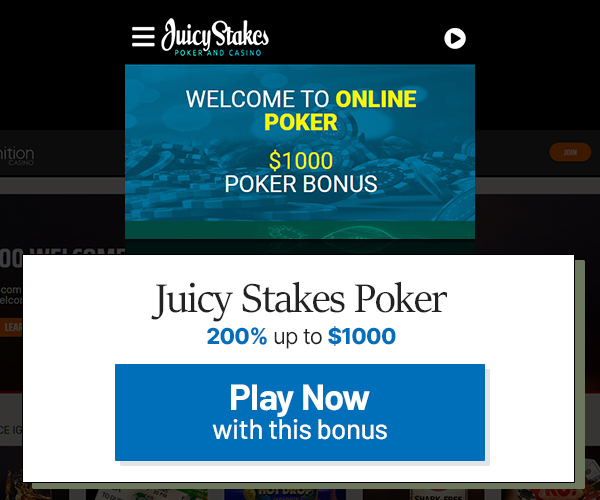

The insurance policy facts eligibility, kind of incentives (lump-share, year-prevent, extra agreements), plus the procedures to own granting these types of incentives. Sure, in our view sportsbook bonuses are an effective way to possess bettors to improve the money. Activating a great sportsbook incentive is generally optional and certainly will be prevented if you so like, but we recommend taking advantage of campaigns when they fit your circumstances.

As an alternative, this type of bonuses are given from the accommodations for the transmits in order to journey repeated flyer apps or the other way around. Having a fixed-price advantages credit card, you can make apartment benefits costs to your all of the orders with no need to tune spinning categories otherwise trigger particular also provides on the an excellent monthly otherwise quarterly base. With this smooth means, you can generate benefits on every get while maintaining a simple and you will simple award-getting techniques. We along with unearthed that 54% of TPG cardholders shell out an annual fee of $350 or more.

Simultaneously, Hyatt is one of the pair resort apps you to definitely nevertheless utilizes a fixed award graph that have top and you may from-level cost, that allows you to receive a good value for your things. So it greeting extra try sold because the cash return, however, made since the Greatest Advantages things. Once we make that it listing, we were surprised at how exactly we discovered multiple notes that people didn’t come across to your most other higher internet sites. Particularly the brand new Denote Business Dollars℠ Card, U.S. Lender Multiple Bucks Rewards Visa Business Card, and you may Financing You to definitely Spark dollars notes was lost away from other directories published somewhere else. Southwest regular leaflets would like the fresh updated boarding positions, inflight Wi-Fi credits, and you may extra things on each cardmember anniversary.

Do not forget to were cash-sharing bonuses or defined contributions (for example, a 401(k) matches otherwise a worker Stock options System (ESOP)) built to pension account. Remember, indicative-on the bonus is to help keep you whole because you trade you to group of payment programs to own a different you to definitely. While the incorrect sort of “worker of your own week” layout will be cheesy, it is all in the performance. A well designed noncash added bonus system is also instill pleasure and you may boost employee spirits. Team that have over a great job need to have in the future to the front away from a packed place at the another ceremony like they are choosing an enthusiastic Academy Prize.

It honours 1% money back once you pick and various other step one% because you pay off their costs. You can also move the cash returning to ThankYou issues via a connected ThankYou cards, such as the Citi Prestige Card. That it cards also incorporates almost every other pros for example smartphone shelter, number one local rental auto publicity (whenever renting for team objectives), get and warranty defenses and you may 100 percent free staff notes. Read all of our review of the field of Hyatt Business charge card to learn more. Read our very own report on the world of Hyatt credit card for more details.

Think of one to for a moment – you give your own financial all of your currency to store. It lend your finances for other consumers and you may make money on the focus and costs. Nonetheless they and profit by charging costs for everyone categories of in love content.

For many who already have a Chase checking account, you could talk with a great banker to help you update the newest account. Since the premier financial in the You.S., Pursue is recognized for their huge real impact, broad Automatic teller machine network and you may accessible support service. Crowne Retail center has much time based their offering to the it’s knowing the blended functions and you will existence requires of its international website visitors. Business traveling isn’t only about team – it’s regarding the balancing work and life feeling effective and you will satisfied. The newest Citi Twice Bucks Card is one of the best no-annual-fee dollars-straight back cards thanks to its straightforward rewards framework.

Residents Checking account – $eight hundred

Apps because of it cards you may close people time now (and you may almost of course until the stop of the year). But not, guess I’d gained the benefit to my Rare metal Discover and you may then the unit altered (or current) they to your Government. If so, I’d have to hold off forty-eight days from the time We gotten the new Rare metal Discover welcome incentive to make the fresh welcome added bonus to your the newest Administrator. The newest forty eight-month several months begins from the time the prior bonus is actually received, perhaps not if the membership is actually open otherwise finalized.

Such, below are a few all of our posts for the improved cards offers to subscribe because of it week and cards already providing signal-right up incentives out of a hundred,100 items or higher. However,, it can be hard to meet the lowest investing standards to earn the bonus during these notes. Credit cards greeting incentive offer is quite worthwhile if you could potentially meet the using demands. A new welcome render is kick-begin the benefits equilibrium and possess you anywhere near this much nearer to your following trips. An informed acceptance offers are worth thousands of dollars inside take a trip. Mastercard greeting extra now offers are continuously switching, plus the worth of points software may vary considerably.